Underrated Ideas Of Info About How To Reduce Taxes On Social Security Income

Calculating your social security federal income tax:

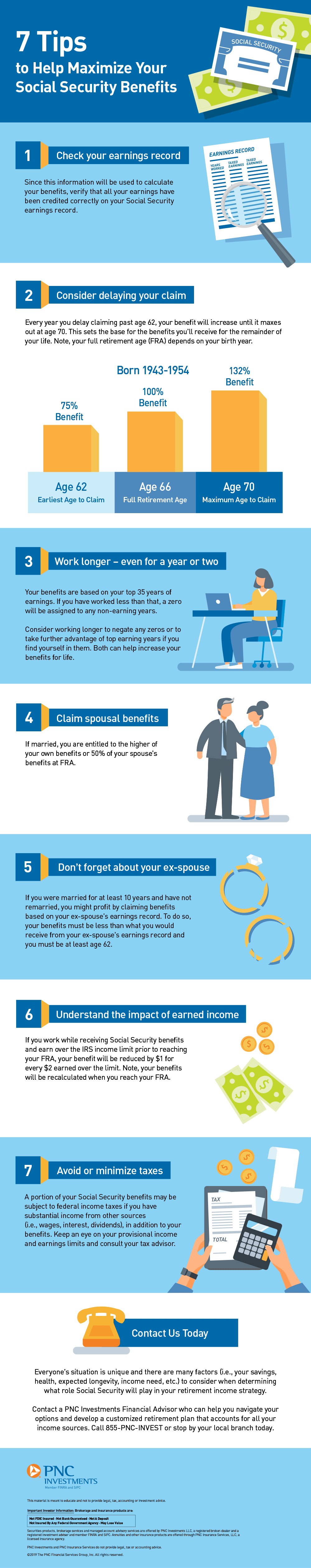

How to reduce taxes on social security income. One way to lower your tax bill is to opt for a qualified charitable distribution, or qcd, which lets you give your required minimum distributions to charity. The social security tax is the first tax to be levied by the irs as part of fica. 2 hours agostates that reduce social security taxation based on age or income.

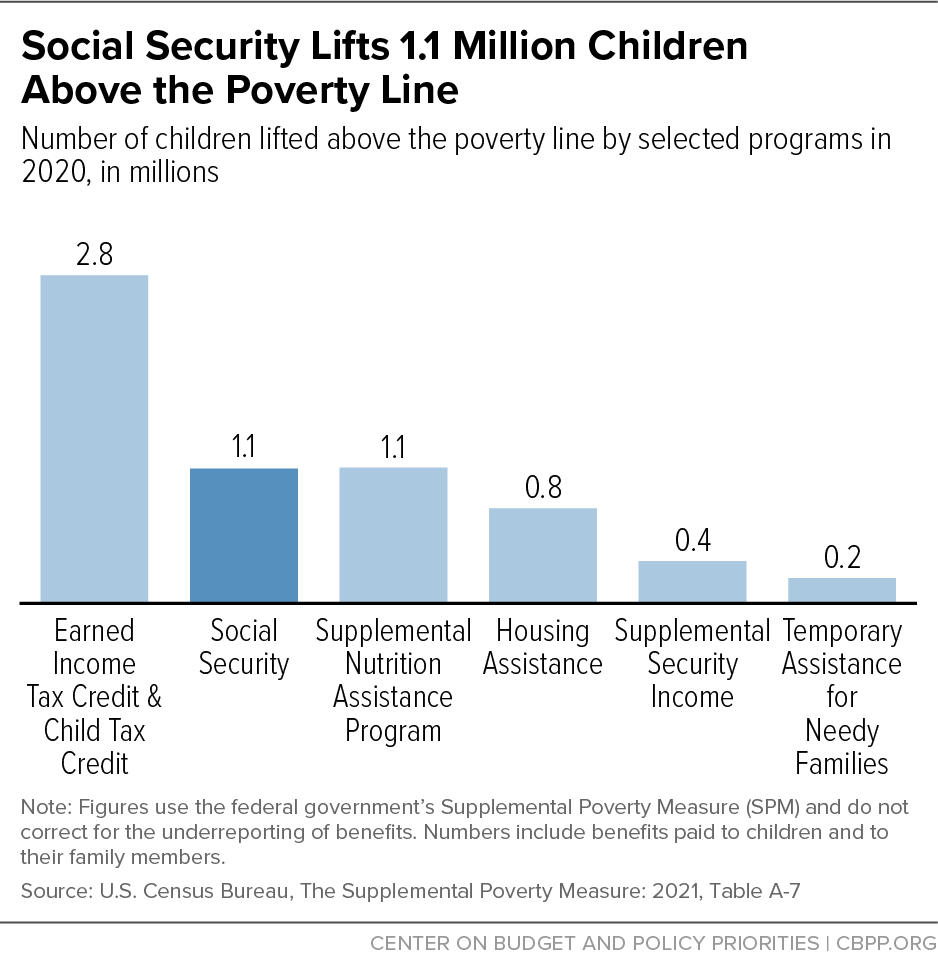

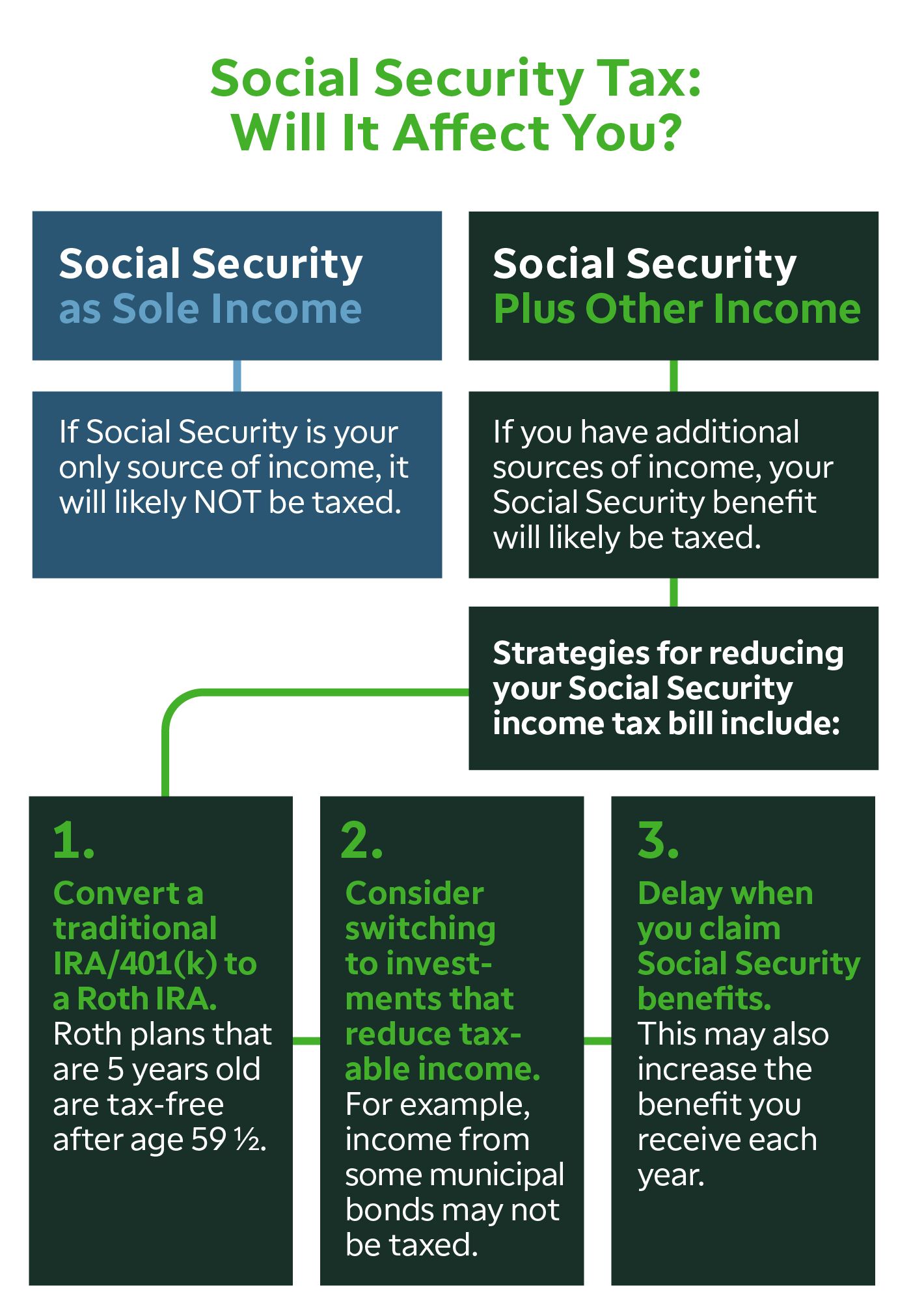

Manage your other retirement income sources. 3 ways to avoid taxes on benefits place some retirement income in roth accounts. As of 2022, social security payments are generally taxable.

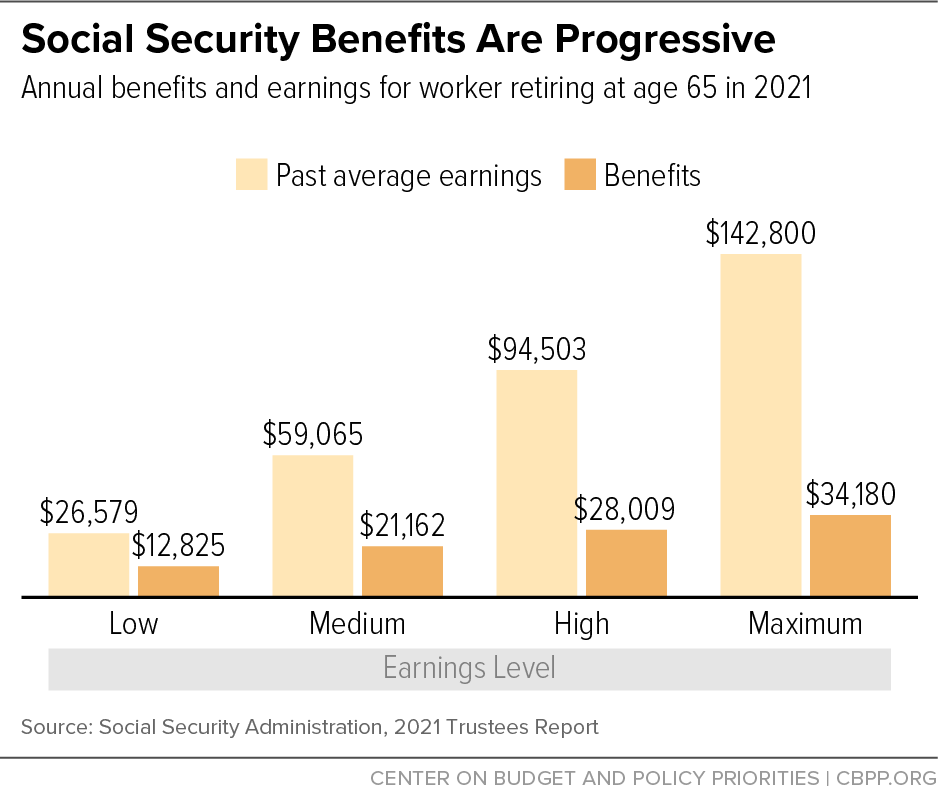

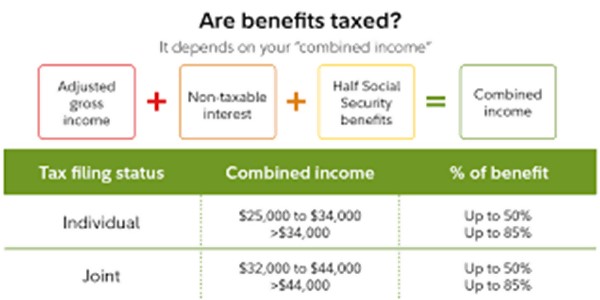

The first step is to compute the potential tax on your benefits. Social security benefits are included with other taxable income at the rate of 85%, 50%, or zero. One of the simplest ways to reduce taxation of social security is to reduce the amount of income you are.

How can i have income taxes withheld from my social security benefits? Married, filing jointly other taxpayers* then: Stay below the taxable thresholds.

One way to lower your tax bill is to opt for a qualified charitable distribution, or qcd, which lets you give your required minimum distributions to charity. One strategy to reduce the taxes you pay on your social security income involves converting traditional 401 (k) or ira savings into a roth ira, says shailendra kumar, director. Retirees from ages 55 to 64 are able to deduct up to $20,000 in retirement income, including.

Strategy #3 tax loss harvesting. Your benefits are not taxed if your income falls below $32,000 (married. The tax is a bit complicated, and.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)